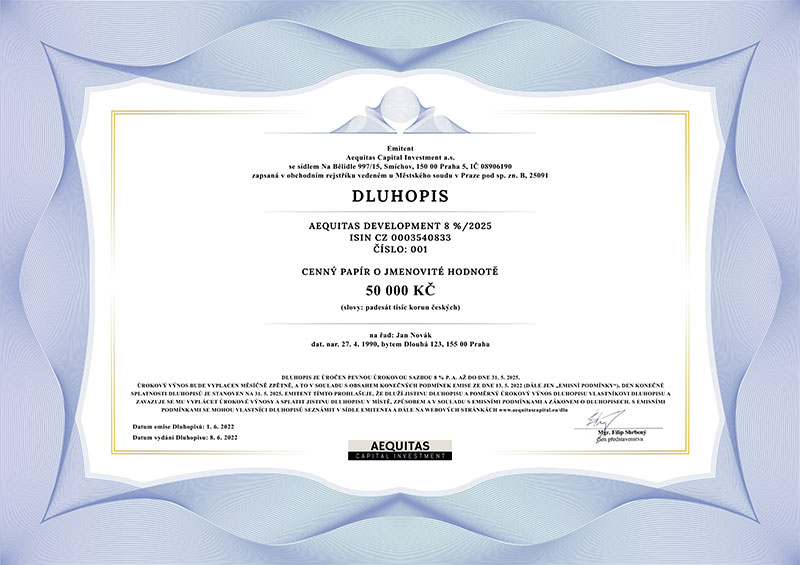

Bonds

Aequitas Capital Investment a.s., part of FQI SICAV, is the bond issuer.

High inflation and rising interest rates. These are the main reasons why your finances are devalued in savings accounts, not to mention checking accounts. At the same time, however, the demand for so-called second living in the Czech mountains is growing, which has been exacerbated by the pandemic situation. Investing your money in real estate bonds is therefore a logical step.

TO WHOM THE BONDS OFFER IS INTENDED

- to investors who are interested in participating in prestigious development projects

- to investors who apply a more conservative strategy – bonds are interest-bearing at a fixed interest rate that does not depend on market development

- to investors who want to evaluate their finances in a shorter time horizon – development projects usually last 2–3 years

WHAT YOU GET BY INVESTING IN AÂ BOND

- above average and fixed yield

- bonds secured by the issuer's property

- professional background of a renowned investment group

FORGET THE SAVINGS ACCOUNT

Value your capital meaningfully.

The bond program of the company Aequitas Capital Investment a.s., with a

duration of 10Â years, has a maximum volume of outstanding bonds of

1 000 000 000 CZK. The CNB was first approved in 2021

fixed interest income of 10% p.a.

investments from CZK 50,000

monthly income payment to your account

investments covered by the assets of the issuer

prospectus approved by the CNB (Czech National Bank)Â *

portfolio of real estate development projects

successfully completed projects

development projects in the Czech Republic

AEQUITAS DEVELOPMENT bond 10%/2026 MONTHLY

with a fixed interest rate of 10% p.a., with a total expected nominal value of up to CZK 30,000,000, maturing on 31 January 2026, with monthly payment of proceeds

Basic parameters of the bond

| Nominal value of one bond | 50 000,- KÄŤ |

| Number of bonds issued | 600 |

| Date of issue | 1. 2. 2023 |

| Final bond maturity date | 31. 1. 2026 |

Downloads

INFORMATION ABOUT THE BONDS ISSUER

Aequitas Capital Investment a. s.

Na Bělidle 997/15

150 00 Prague 5

E-mail: info@aequitascapital.eu

Phone: +420Â 603Â 937Â 776

ID: 08906190

VAT No.: CZ08906190

File number: B 25091 held at the Municipal Court in Prague

Basic capital: 2Â 000Â 000Â CZK

Data box: p7kpy99

Part of FQI Aequitas Capital Investment SICAV a. s.

Member of AEQUITAS Group